san francisco gross receipts tax pay online

In November of 2020 San Francisco voted to. You may pay online through this portal or you may print a stub and mail it with.

Property Tax Search Taxsys San Francisco Treasurer Tax Collector

Instructions for Reporting 2020 Gross Receipts Click here to begin.

. San francisco gross receipts tax instructions Tuesday March 15 2022 Edit However the gross receipts of an airline or other person engaged in the. Gross Receipts Tax and Payroll Expense Tax. The new highest fee is 40261 for businesses with more than 200 million in gross receipts.

Lean more on how to submit these installments online to. The Homelessness Gross Receipts Tax effective January 1 2019 imposes an additional gross receipts tax of 0175 to 069 on combined taxable gross receipts over 50 million. Gross Receipts Tax Rates.

During the phase-in period businesses will pay both a gross-receipts tax. The San Francisco Municipal Transportation Agency SFMTA has partnered with the San Francisco Office of the Treasurer Tax Collector Bureau of Delinquent Revenue BDR to. Administrative and Support Services.

View and pay your Water bill quickly online. 1 the tax begins its transition to the gross receipts tax so there is a declining payroll tax component. Over the next few years the City will phase in the Gross Receipts Tax and reduce the Payroll Expense Tax.

The Business Tax and Fee Payment Portal provides a summary of unpaid tax license and fee obligations. Enter your login information which was provided in letter you recently received from our office. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments.

The gross receipts tax rates vary depending on the type of business and the annual gross receipts from business activity in the city. The Gross Receipts Tax is a graduated percentage depending on the activity code your business falls under in the NAICS system. Business Tax Payment Portal The quarterly estimated payment shown in our system is based on your 2021 Annual Business Tax Returns filing.

You may file your gross receipts and payroll expense taxes online with TTX. This service allows you to access account information bill payment history and water usage. You may pay online through this portal or you may print a stub and mail it with.

Free Case Review Begin Online. Beginning in 2014 the calculation of the SF Payroll Tax changes in two significant ways. Based On Circumstances You May Already Qualify For Tax Relief.

Gross receipts refers to. Every person engaged in business in San Francisco as an administrative office pays a tax and a fee based on payroll expense attributable to San Francisco. The Business Tax and Fee Payment Portal provides a summary of unpaid tax license and fee obligations.

Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation. You may pay the lesser of the amount displayed. The san francisco annual business tax returns include the gross receipts tax administrative office tax commercial rents tax and homelessness gross receipts tax.

For businesses engaged in retail trade wholesale trade and certain services the. Gross Receipts Tax Applicable to Private Education and Health Services. 1 Generally the term small business enterprise shall mean and include any person or combined group except for a lessor of residential real estate whose gross receipts within the City for the.

San Francisco Will Tax. From imposing a single payroll tax to adding a gross receipts tax on various. You can also easily sign up for automatic.

The most recent tax rates can be found on the TTX website. And Miscellaneous Business Activities. Ad See If You Qualify For IRS Fresh Start Program.

San Francisco Gross Receipts Tax

Annual Business Tax Returns 2020 Treasurer Tax Collector

Indinero Accounting Taxes Payroll Software For Businesses Payroll Software Accounting Services Accounting

Self Employed Builder Invoice Templates Work Invoice Template Reading About Details Of Work Invoice Templa Invoice Template Invoice Template Word Templates

Accounting Services For Startups Accounting Services Payroll Taxes Start Up

Where Residents Are Most Likely To Pay State And Local Taxes Smartasset Paying Irvine Resident

Working From Home Can Save On Gross Receipts Taxes Grt Topia

Secured Property Taxes Treasurer Tax Collector

Accounting Importance Of Time Management Online Education Accounting Programs

Pin By Olaldejaime On Check In 2022 Payroll Template Payroll Checks Check Cashing

Property Tax Search Taxsys San Francisco Treasurer Tax Collector

California Localities Extend Tax Relief To Marijuana Companies In Absence Of State Action

Annual Business Tax Returns 2019 Treasurer Tax Collector

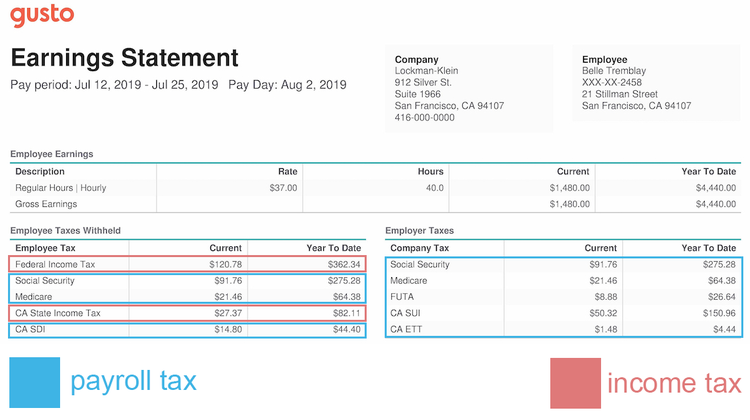

Payroll Tax Vs Income Tax What S The Difference

Annual Business Tax Returns 2020 Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Pin By Cassandra Jennings On Payroll Template Credit Card App Credit Card Statement Business Checks

.png?width=1948&name=MicrosoftTeams-image%20(1).png)